Editor’s Note: This post was originally published in January 2014 and has been updated for accuracy and comprehensiveness.

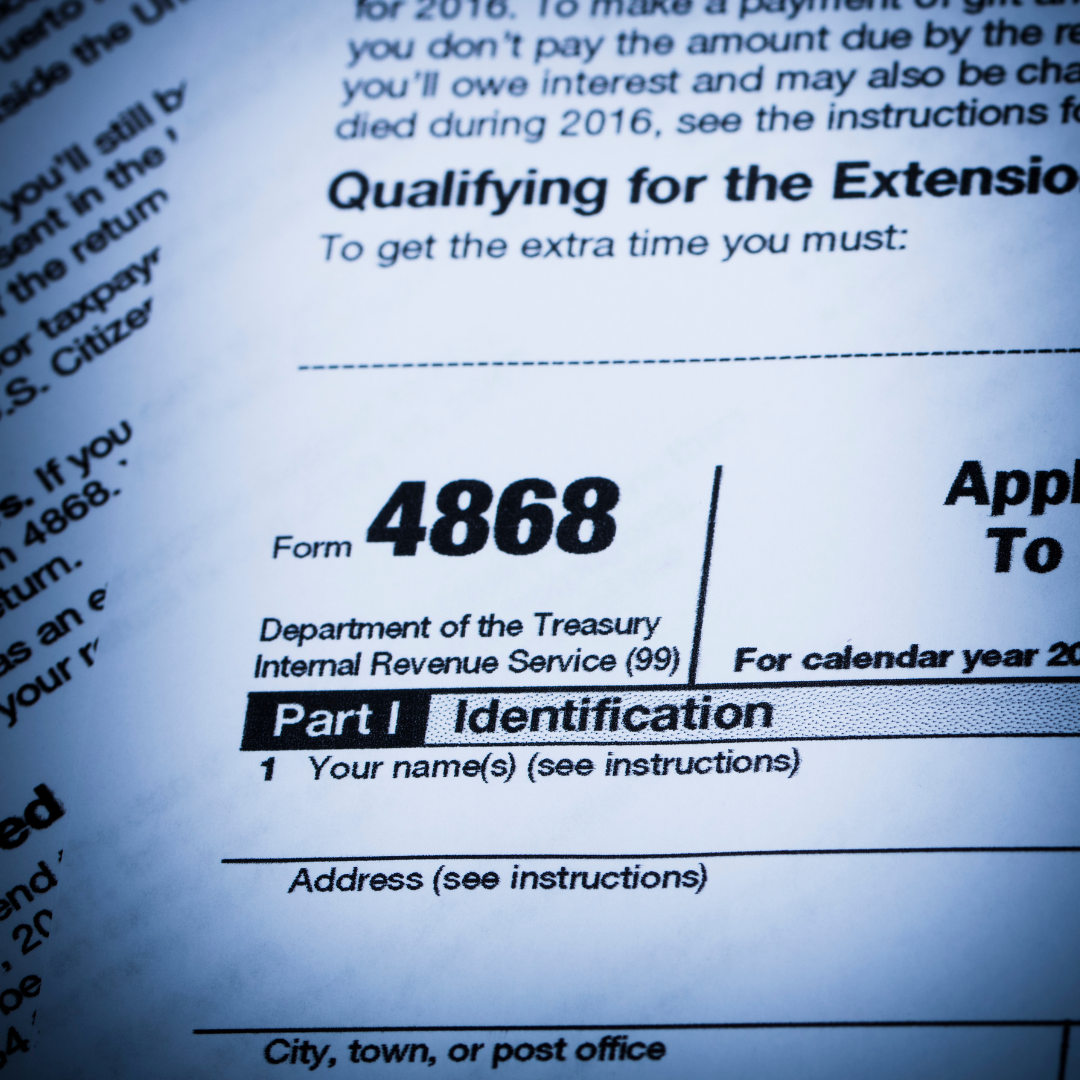

Having a baby is an exciting life event, but it also comes with significant expenses—many of which start during pregnancy. The good news is that certain pregnancy-related medical costs may be tax-deductible, helping you ease the financial burden. However, not all expenses qualify. Understanding which maternity costs you can and can’t deduct will help you keep better records and maximize your potential tax savings.